UI, Customer Experience, CRM Development, API Development, third party integration

Underwriting & General Insurance Services (UGIS) approached White Feather Designs to develop a platform that would allow their netwrok of brokers to access their products and create and manage insurance policys, insurance claims and renewals for their customers.

The insurance underwriting industry over the years has become very competitive. Insurance underwriters work very closely with brokers and rely on broker netwroks to gain new business.

Insurers need to be able to offer more competitive products, rates and speedier ways of closing business.

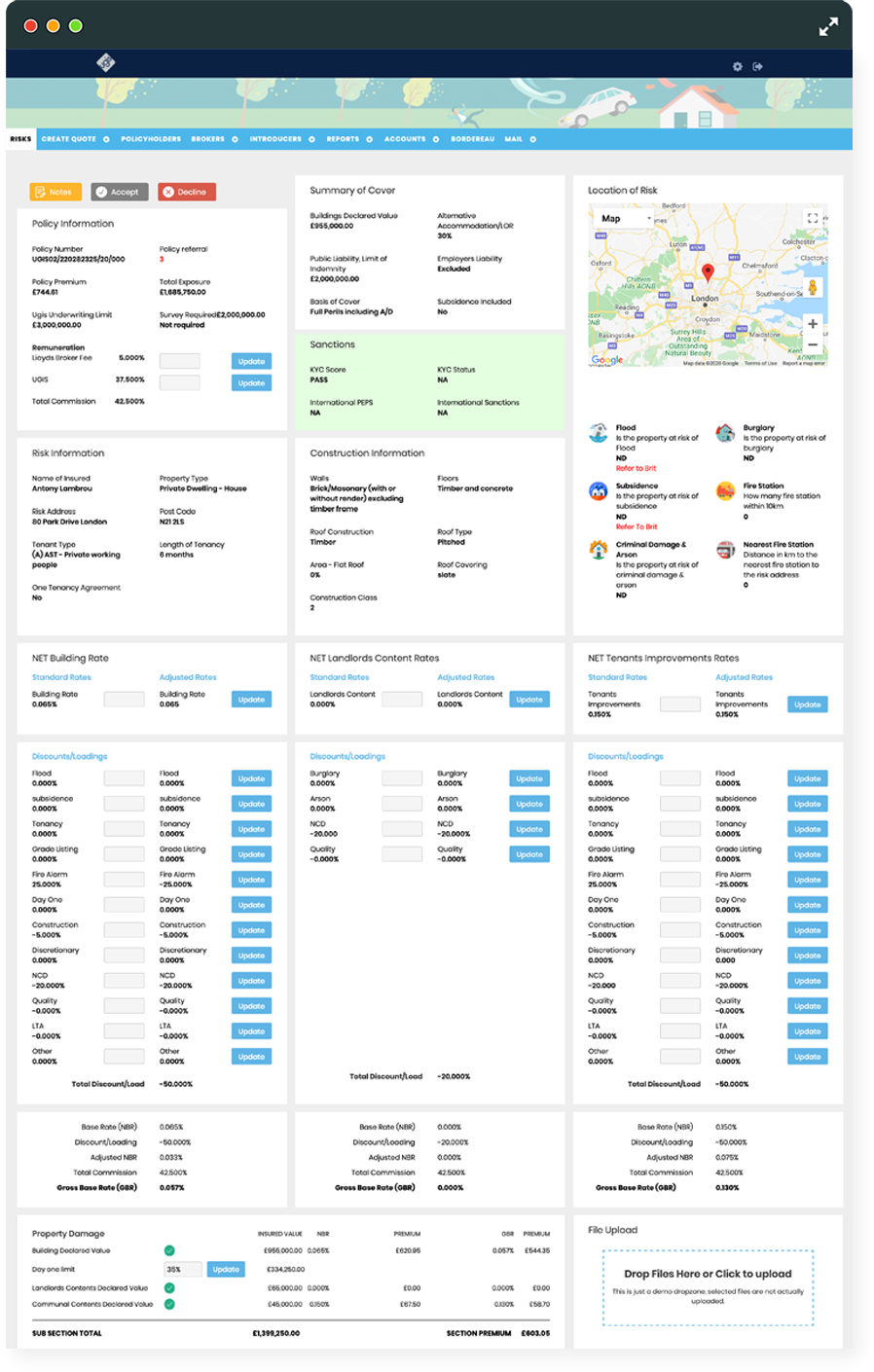

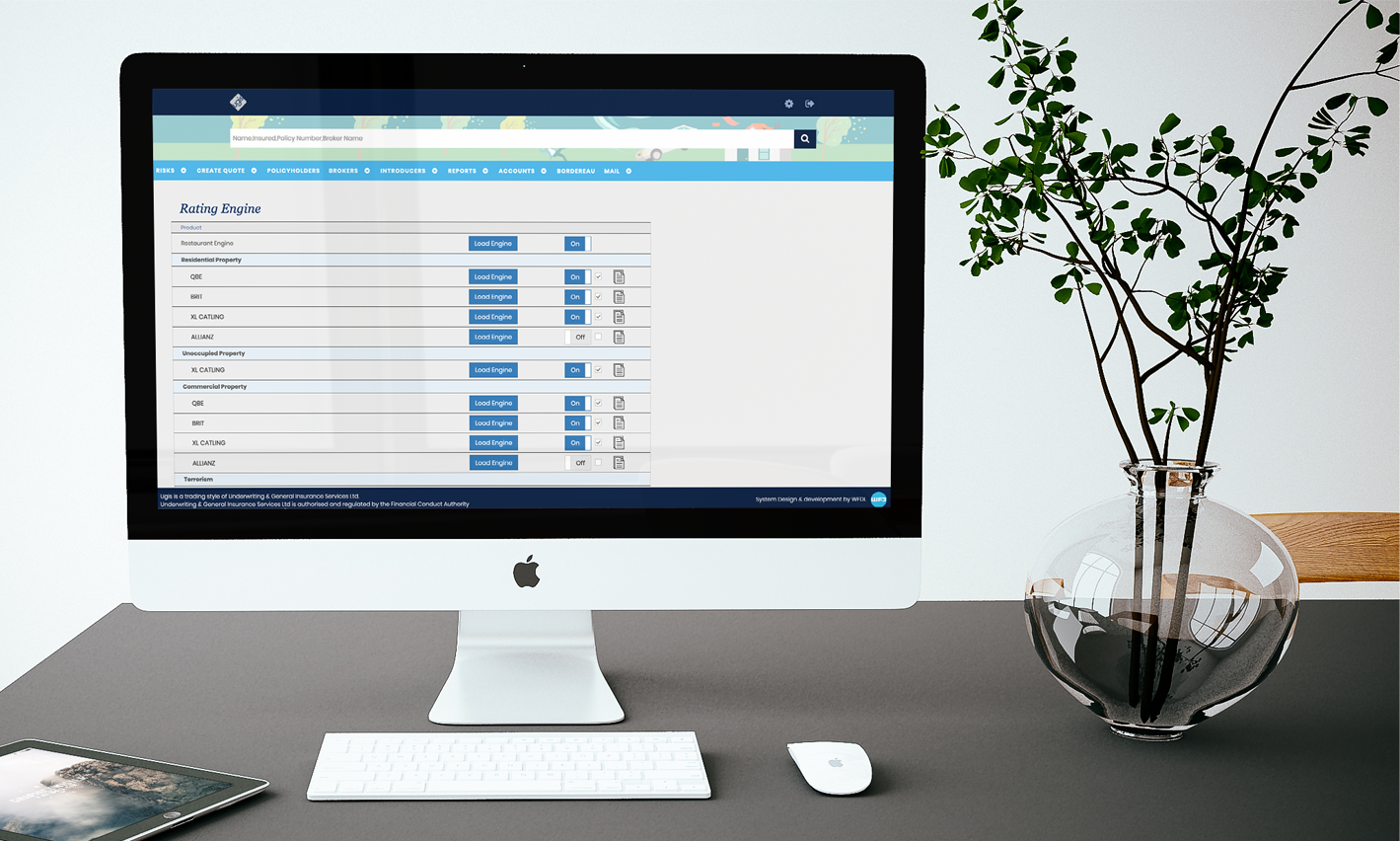

In order to process quotes, claims and renewals, the UGIS platform had to be built around a sophisticated rating engine that would carry out all the calculations required to provide a premium.

There are many occasions when a quote can not be provided. This can be due to various conditions not being met or levels being exceeded. The rating table needed to be able to process referrals as well as quotes.

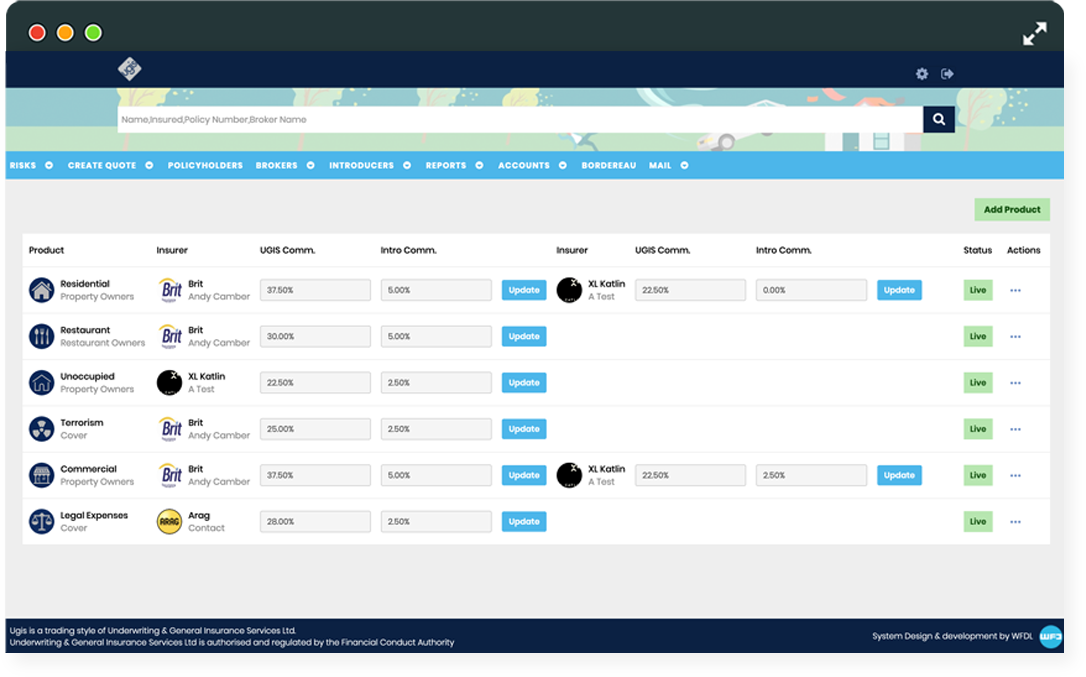

UGIS have a number of insurers they work with that provide the same products. This means they are in a great position to offer their clients comparison quotes. The platform would be required to do this.

UGIS now have a system called Vibrant which allows complete customer management and multiple policies for different business types. Vibrant can handle claims and renewals and has a full paperless office document generation and management system built-in to produce all documentation. It is a full end-to-end system allowing front-end customer use and integration to the complete back-office management.

Using their developed rating engine, UGIS now have a system that allows their network of brokers to login and generate quotes and purchase policies without any offline interaction. Vibrant also allows for mid-term adjustments, and claims and automates the renewal process.

The system is intelligent enough to work out premium charges and adjusts the amounts chargeable proportionally. All of this can take place without the need for any manual calculations.

It can produce schedules, statements of fact, quotations, policy documents, welcome letters and emails automatically for online purchase execution only websites - or at the click of a button for companies that prefer to keep a slightly more manual touch.

These then automatically attach to the case audit log, so that users can see what has been generated and what has been sent. Senior policy administrators can also be allowed to make changes to all or selected documents.

UGIS now have a platform that eliminates the need for paper documents. All administration can be accessed and performed online within the Vibrant system. Vibrant stores client data, policies, claims, tasks, notes and generates policy documents.

The Vibrant broker platform is driven by a very powerful back office CRM. The various rating engines drive the quotes that are

produced for single and comparison quotes. Built-in credit and KYC checks provide UGIS with an instant screening of the proposed insurer.

As well as being totally permissions based, Vibrant also allows for management to set in-house underwriting levels. This means that only certain members of staff can write business over specific values.

Their broker network can login securely to their account, select a specific insurance policy, apply and purchase cover for their clients, with any referrals initially reviewed by an admin.

All policy documentation, quotation schedules, policy wordings, summary of cover, policy schedules, EL Certificates are all produced via the system.

Vibrant enables brokers to manage their entire pipeline and know exactly at what stage any of their cases are from one screen. Important management information is displayed exactly how they require it.

Vibrant is a real time platform so any updates on the system are in real time.

Working with WFDL is an absolute pleasure. They just seem to get us. The Vibrant platform was our first venture online and we were apprehensive. WFDL made it a pleasure. We are overjoyed with the results, and the ongoing support is second to none."

Working with WFDL is an absolute pleasure. They just seem to get us. The Vibrant platform was our first venture online and we were apprehensive. WFDL made it a pleasure. We are overjoyed with the results, and the ongoing support is second to none."