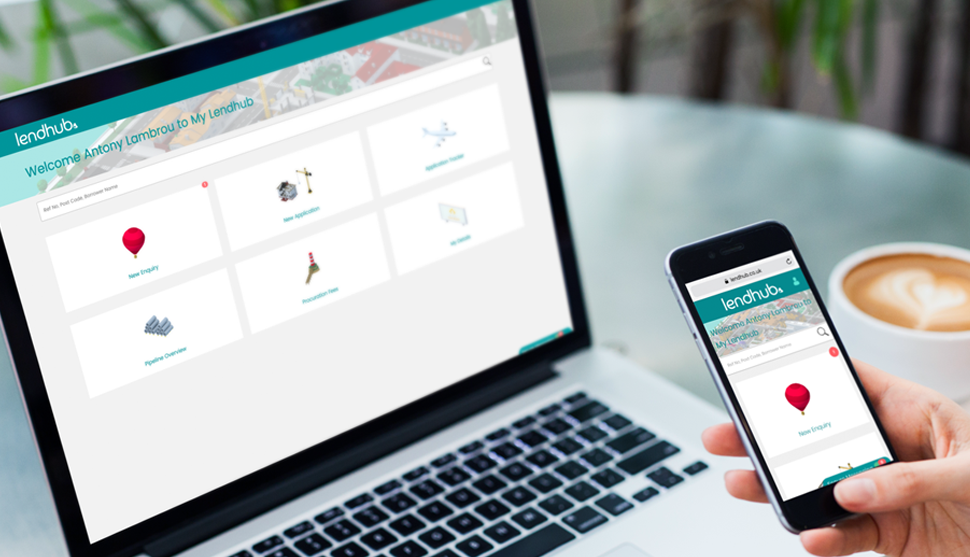

APP Development, UX, Customer Experience, CRM Development, API Development Lendhub are a forward-thinking property finance company who like to do things differently. They approached White Feather Designs to develop MyLendhub, a broker driven platform to seemlessly manage property finance enquiries, applications and loans.

The property finance industry is very competitive. Lenders work closely with brokers and introducers to receive introductions and applications when competing for new business.

Brokers and introducers are continually looking for lenders with an advantage that will allow for applications to be processed quicker and converted to loans.

From the outset of this project, it was very clear that providing brokers with the right tools to quickly and easily manage and execute loan enquiries and applications was a very high proirity.

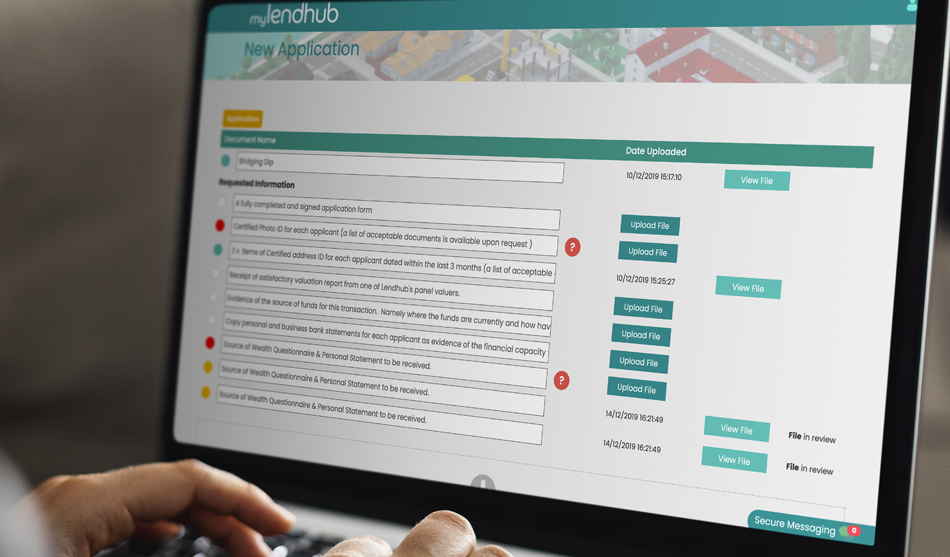

Capturing loan details submitted for enquiries and applications is just the first part of the cycle. How the submitted details are then processed, and how quickly the brokers are updated is equally as important.

All loan applications require a signature from the borrowers before they can be processed. This means applications with multiple borrowers would require all boorowers to provide a signature.

The first stage to developing MyLendbhub was to conduct some thorough research with key members of staff to understand the steps required to process a loan. It was also important for us to understand the issues faced by both brokers and borrowers when submitting and then processing a loan application.

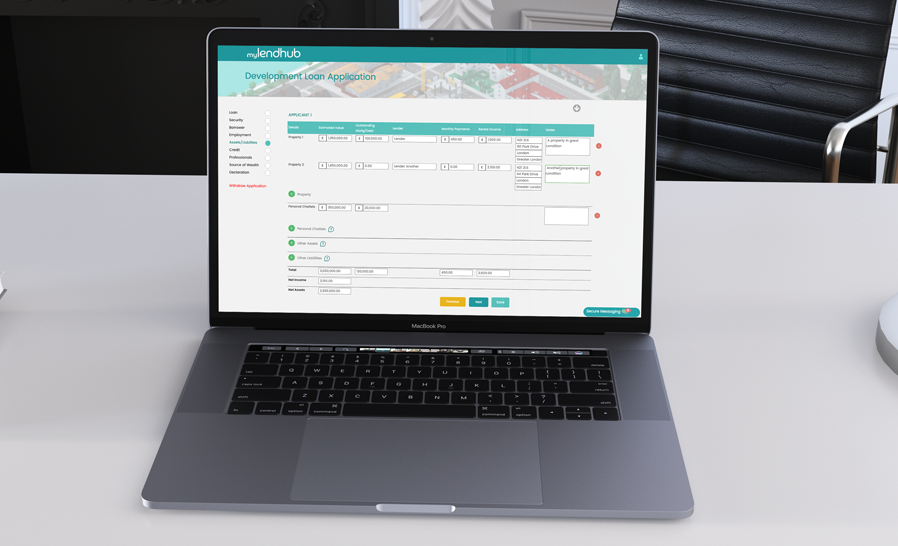

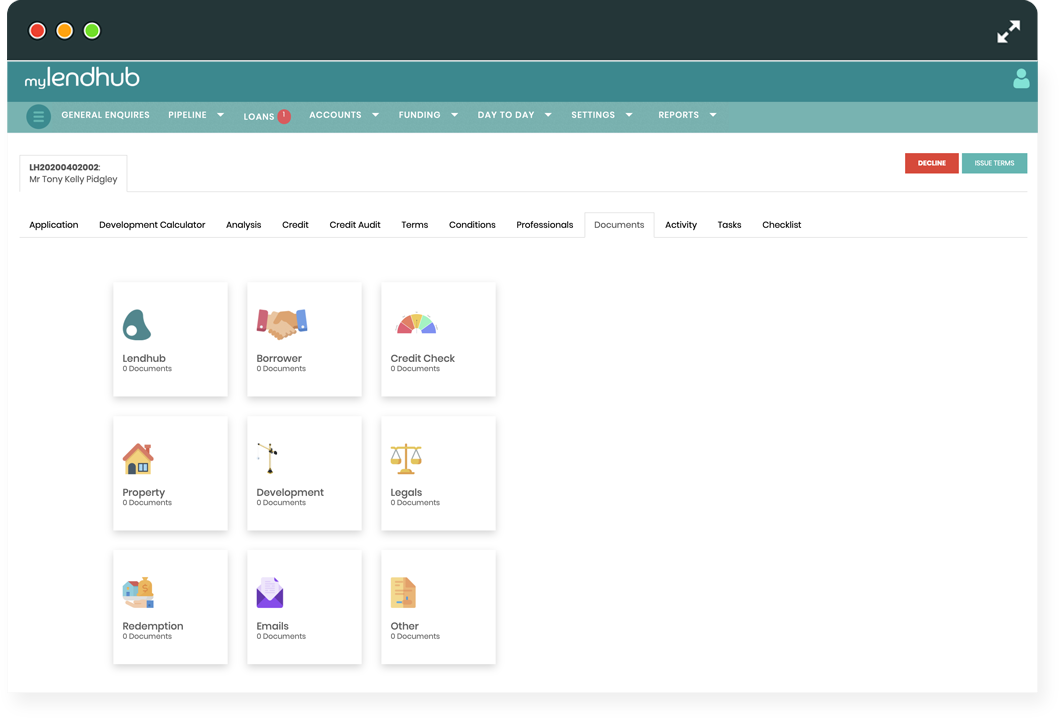

This research enabled us to develop an intuitive platform, built with the broker and borrower journey at the heart of the design and functionality. MyLendhub removes the need to rekey information within the application by prefilling form fields from the enquiry stage. Administrative hassle will be a thing of the past as the platform enables the user to view and accept DIPs and Terms and then have the ability to email documentation directly to clients for digital signature, removing the need to print and post and so inreasing considerably the speed from start to finish.

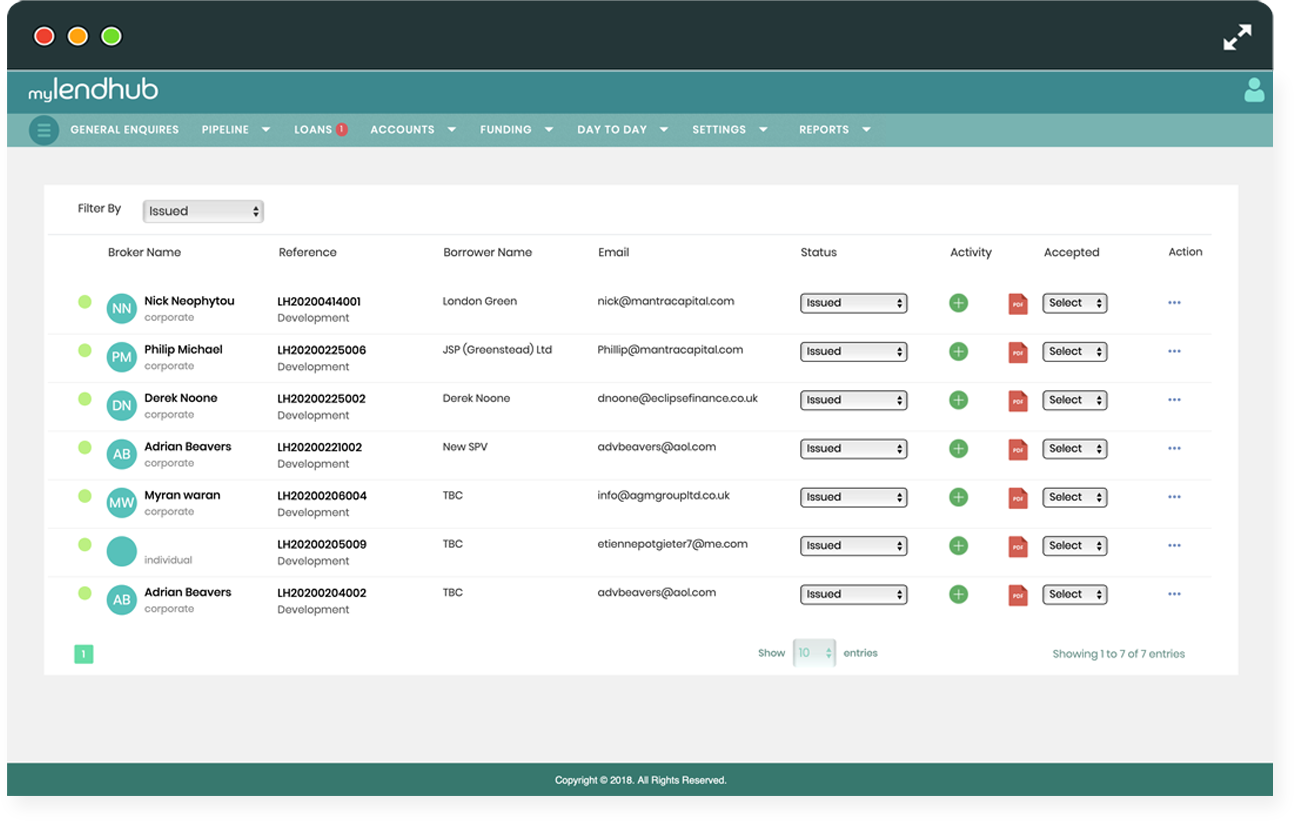

Pipeline case management is made simple with users able to see all their cases and the stages they are at all from one screen. The system enables complete visibility with instant notifications and real-time information, so no need to chase for updates. Required documentation is requested and satisfied via the platform. Users of the platform can now start to enjoy a paperless way of working and do their bit for the environment.

The MyLendhub broker platform is driven by a powerful back office CRM. It supports enquiries from both direct customers and 3rd party introducers. When enquiries and applications are submitted by a broker or borrower, they are fed into the CRM to be processed.

Built in credit and KYC checks provide Lendhub with an instant overview of the borrowers financial position. Built in checks allow for the system to keep track of an applications current progress.

The system is also totally permission based which means Lendhub can allocate staff to focus on specific parts of the system. This inrceases efficiency and productivity.

Lendhub are able to take their end users from enquiry through underwriting and payout to instalment collections, arrears management and settlement through their system.

Applications are autofilled from a prequalified enquiry. Issuing DIPs and Terms send instant notifications to brokers so that they can act quickly in reviewing and accepting the issued documents.

Through myLendhub, brokers are able to manage their entire pipeline and know exactly at what stage any of their cases are - all from one screen. Important management information displayed exactly how they require it.

MyLendhub is a real time platform. This means any updates on the system and real time alerts are sent to the appropriate person - Broker, BDM, administrator.

Don't miss a thing, notifications sent directly to you as soon as your case is updated.

Review and accept DIPs and Heads Of Terms

Send documents directly to your customers to complete and sign.

No more rekeying! Your application will be autofilled from your enquiry.

Review and accept DIPs and Heads Of Terms.

Manage your pipeline and know exactly what stage

your cases are at all in one screen Management information, exactly how you want it.

We have a multifaceted lending platform that not only looks visually spectacular, but has the capabilities and performance to match. Ongoing support has been fantastic and we would recommend White Feather Designs for a variety of technological requirements."

We have a multifaceted lending platform that not only looks visually spectacular, but has the capabilities and performance to match. Ongoing support has been fantastic and we would recommend White Feather Designs for a variety of technological requirements."